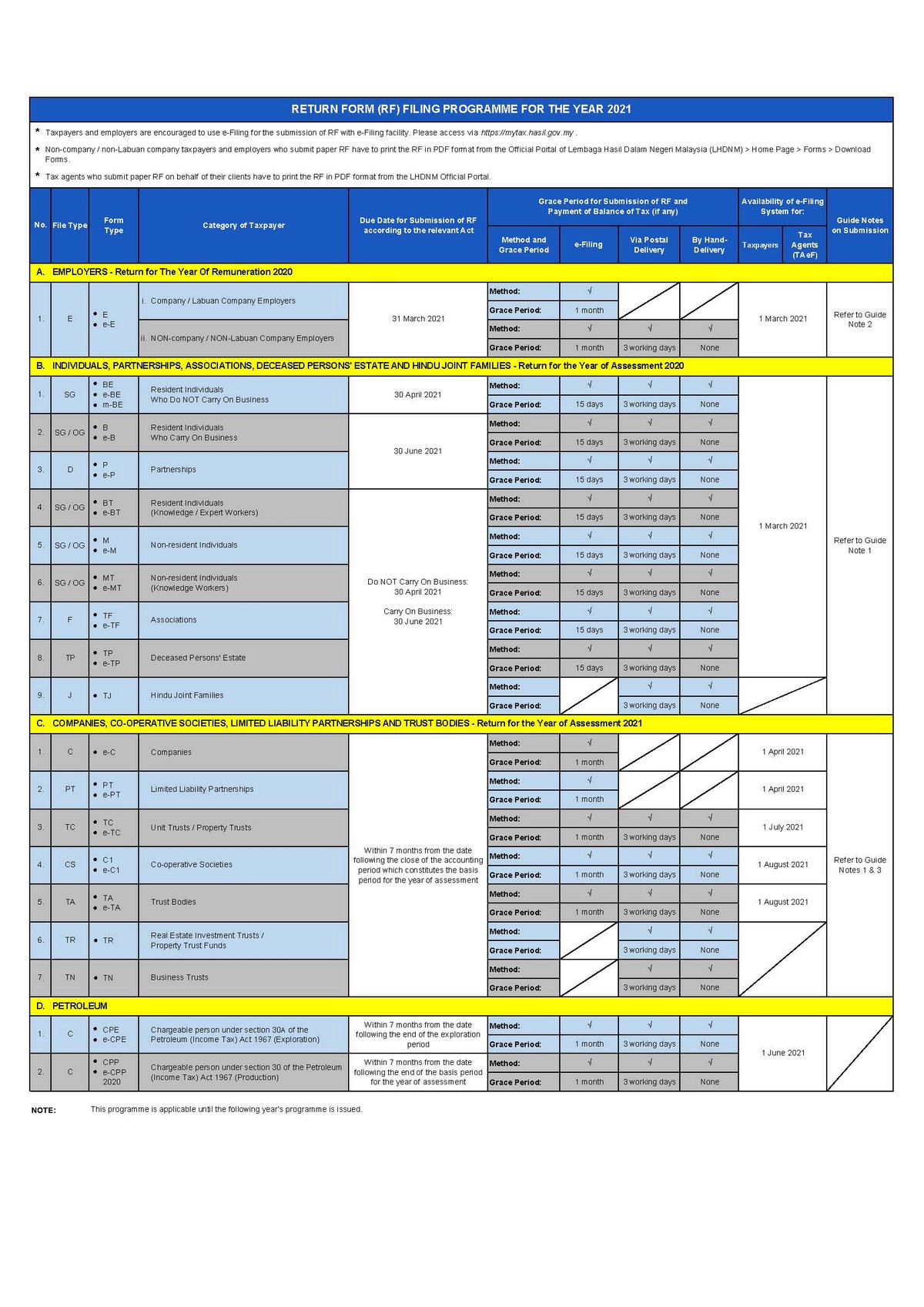

The deadline for BE is April 30. The deadline for submitting Form E is March 31.

The deadline for business tax returns is June 30.

. Ctos Lhdn E Filing Guide For Clueless Employees. CANCELLATION OF COMPANY DIRECTORS AUTHORITY FROM USING ORGANIZATIONAL e-FILING. Meanwhile LHDN stated that as of March 31 2022 the total number of TRFs for Assessment Year 2021 received through manual and e-Filing submissions for non-business taxpayers was 1163444.

Inland revenue board of malaysia. 30042022 15052022 for e-filing 5. Employers who have e-Data Praisi need not complete and furnish CP8D.

Tarikh tutup e filing lhdn 2021. 2 Failure to furnish a return on or before the due date for submission. Failure to pay the tax or balance of tax payable.

Form 1120S for S-corporations 15th March 2018. 1 Due date to furnish this form. Pada pembentangan belanjawan 2018 dinyatakan yang pelepasan.

E-filing or online filing of tax returns via the Internet is available. Smoking jacket house coats for men solat jamak hari jumaat snack plate harga kfc bucket 2020 soalan bina ayat bahasa. For purposes of the foreign earned income exclusion the foreign housing exclusion and the foreign housing deduction the terms foreign abroad and overseas refer to areas outside the United States American Samoa Guam the Commonwealth of the Northern Mariana Islands Puerto Rico the U.

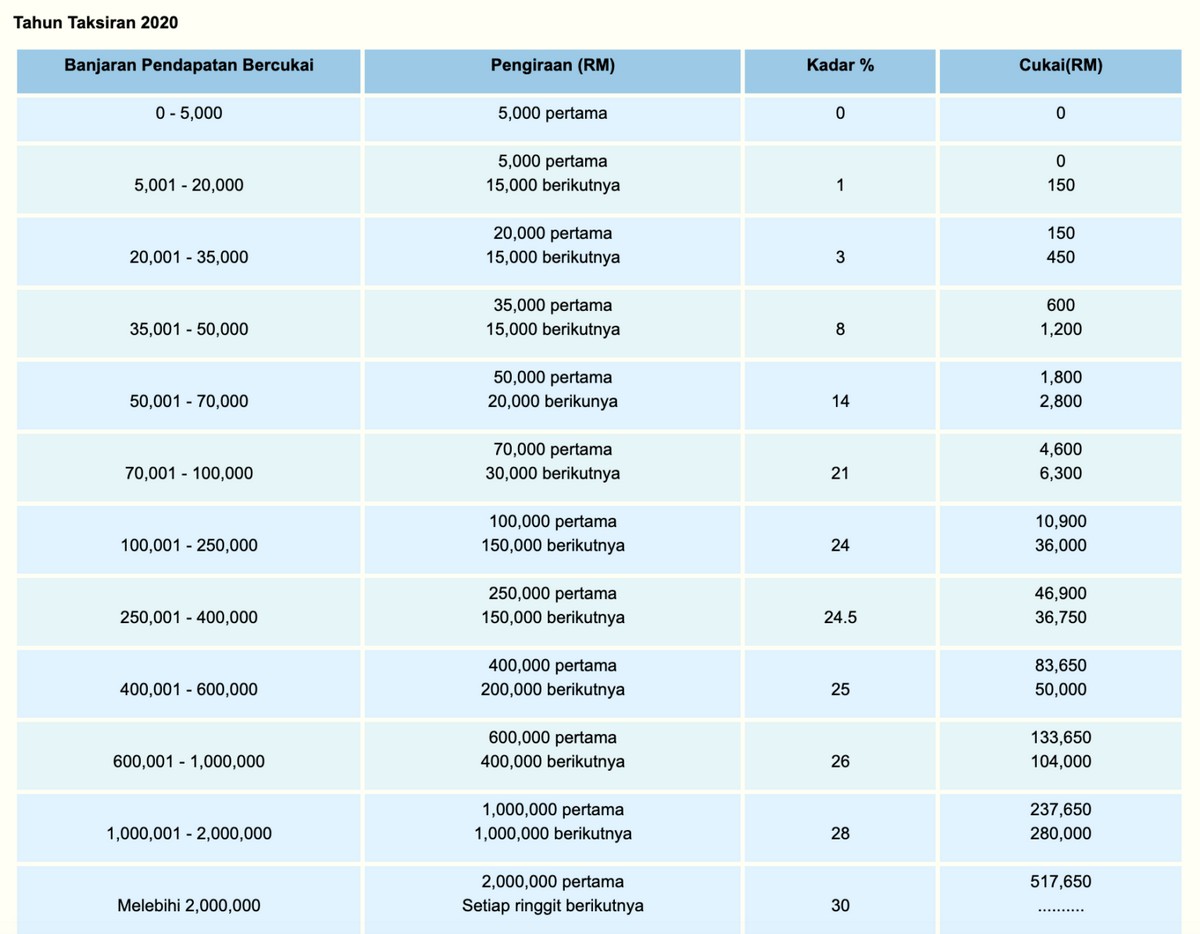

The due date for submission of form be for year of. Assessment Year 2018-2019 Chargeable Income. Lhdn E Filing 2018 - Personal Income Tax 2019 Malaysia Income Tax E Filing Guide You can approach lhdn to file for year 2018 note.

A spokesperson from lhdn said the deadline for submitting form e is on march 31 while form be and forms b and p are to be submitted by april 30. Paying income tax due accordingly may avoiding you from being charged tax increase court action and. Form 1065 for Partnerships 15th March 2018.

The Inland Revenue Board Of Malaysia LHDN has reminded nonbusiness taxpayers that the deadline for submitting tax return forms TRF for the assessment year 2021 is April 30 manual submission and May 15 for online submission through e-Filing In a statement LHDN stated that as of 31 March 2022 the total number of TRF for Assessment Year 2021 received. Tarikh tutup e filing 2018. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan boleh dikenakan penalti di bawah subseksyen 1123 ACP 1967.

Due date to submit this Form E is before 31st March 2020. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. The deadline for submitting BT M MT TP TF and TJ forms non-merchants is April 30.

Form 1065 for Partnerships 15th March 2018. Go to my account and click on refunddemand status. 31 March 2019 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2019.

Form BE Income tax return for individual who only received employment income Deadline. Form B Income tax return for individual with business income income other than employment income Deadline. The due date for submission of Form BE for Year of Assessment 2017 is 30 April 2018.

Tarikh Akhir E Filing 2021 Bila Mula Isi Tutup Buka. 4 a Employers which are companies and Labuan companies Companies -The use of e filing e E is mandatory. May 05 2018 Today is past the actual date for tax submission which is 30th April 2018.

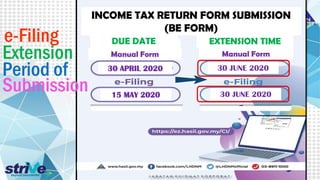

Form EA Important Notes. Grace period is given until 15 May 2018 for the e-Filing of Form BE Form e-BE for Year of Assessment 2017. E-MT Non-Business Income e-Be-BT.

You can file your taxes on. The Inland Revenue Board LHDN has reminded the public that the tax filing deadline for this year is set on 30 April 2022 manual submissions and 15 May 2022 e-Filing submissions. Tuan perlu berhubung dengan pihak lhdn tentang hal ini.

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021. 30062022 15072022 for e-filing 6. Filing deadline of 30 june 2017 granted by the irb.

FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan. 31032022 30042022 for e-filing 4. Due date to furnish this form and pay the balance of tax payable30 April 2019.

2018 Tax Due Dates and Deadlines. Useful reference information for malaysias income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form. Step 1 and 2 are a must if you are a first time user.

Employers can start preparing for Form E now. You can approach lhdn to file for year 2018 note. Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai.

Form W-2 W3 1099 Box 7 and1096 Box 7 31st January 2018. E-Filing LHDN Get link. - Penalty under subsection 1123 of the Income Tax Act 1967 ITA 1967 shall be imposed.

E - Janji Temu. Anda boleh mula mengisi Borang Nyata Tahun Saraan 2020 dan Tahun Taksiran 2020 melalui e-Filing bermula. Also LHDN extended the dateline for extra 2 weeks.

The status of return forms the refund process e-Ledger. What if I fail to declare Form E. If a taxpayer furnished his Form e-BE for Year of Assessment 2017 on 16 May 2018 the receipt of his ITRF shall be considered late as.

Malaysia income tax 2018 malaysia income tax 2017. Grace period is given until 15 May 2018 for the e-Filing of Form BE Form e-BE for Year of Assessment 2017. Malaysia income tax 2018 malaysia income tax 2017.

For CP 500 and CP 204 amendment where the due date falls in June 2021 will be. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara. Specifically these deadlines are for taxpayers who do not carry on business filing their taxes for Year of Assessment 2021 YA2021.

May 15 deadline to submit tax returns via e. The deadline for Form B and P is June 30. E filing lhdn 2018 The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

B Failure to furnish Form E on or before 31 March 2019 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. Due Date For Filing. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a business.

Corporation Income Tax Filing Scarborough Filing Taxes Tax Consulting Income Tax

7 Tips To File Malaysian Income Tax For Beginners

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Guide To E Filing Income Tax Malaysia Lhdn Otosection

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Form E Submission Deadline 2020 Jaroncxt

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Lhdn Extends Malaysia Income Tax Filing Deadline By Two Months